New Delhi: Days after the Reserve Bank of India (RBI) reduced the key interest rates, public sector bank Punjab National Bank (PNB) has reduced its External Benchmark Linked Rate (EBLR) effective March 1, 2025, that will have an impact on the EMIs of loan borrowers.

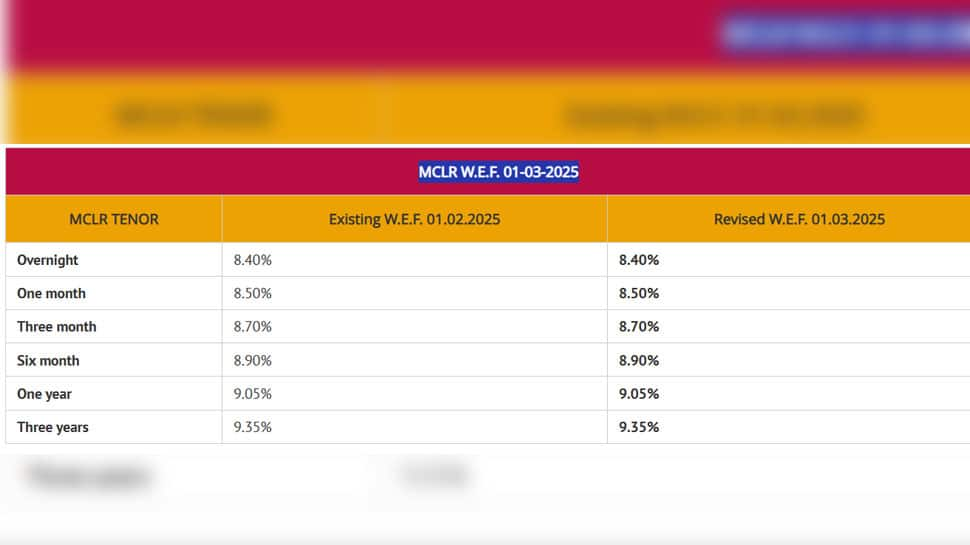

Additionally, PNB has increased its marginal cost of funds based lending rate (MCLR) for loans with the same effective date i.e, March 1, 2025.

Check out new PNB EBLR and MCLR rates effective from March 1, 2025

DISCLOSURE ON EXTERNAL BENCHMARKS LINKED FLOATING RATE LOANS

MCLR rates effective from March 1, 2025

The RBI reduced the repo rate by 25 basis points (bps), from 6.50% to 6.25%, last month. This move will cause banks to revise their lending rates. Banks base the interest rates they provide to customers on the Repo-Linked Lending Rate (RLLR), which is the RBI’s repo rate. Customers who have home loans linked to RLLR may see fluctuations in their interest rates as repo rates change.

All newly issued floating rate bank loans are now subject to EBLR, and any changes to EBLR will have an effect on the EMIs. If a bank reduces EBLR, the borrower will see a decrease in tenure or EMIs.

How does EBLR impact loans?

The EBLR varies in tandem with changes in the repo rate. This has a direct impact on your loan payments. Because EBLR is based on external benchmarks, such as the repo rate, any changes to this benchmark will affect the interest rate on your loan. This implies that your loan EMIs will decrease along with the EBLR when the repo rate declines.

What is EBLR?

Banks use the External Benchmark Lending Rate (EBLR), a benchmark interest rate, to calculate lending interest rates. This is linked to an external benchmark, such as the repo rate set by the RBI. As a result, changes to the benchmark cause changes to the EBLR and loan interest rates. EBLR is usually used for floating-rate loans. Home, personal, and auto loans are linked to EBLR.

What is MCLR?

Banks employ a benchmark called the Marginal Cost of Funds based Lending Rate (MCLR) to determine the minimum interest rates for loans. Banks use this benchmark to help determine interest rates. It serves as the floor for loan interest and may change over time.