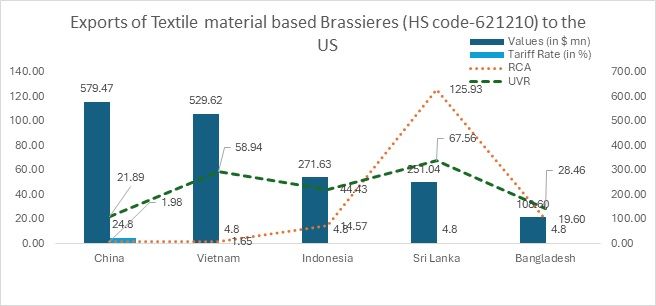

Table 1: Top 5 Exporters and Trade Statistics in CY 2024 – Brassieres of Textile Materials (HS code 621210)

The recent imposition of 20 per cent US tariff on Chinese brassieres (HS 621210) is reshaping the market.

China’s Unit Value Realisation (UVR) of $21.89/kg, once a cost advantage, now faces pressure from increased tariffs, potentially reducing its competitiveness.

Vietnam, Indonesia, and Sri Lanka may capture market share by offering diverse price and quality options.

Source: TradeMap and F2F Analysis *Effective March 4, 2025

Note: RCA – Revealed Comparative Advantage; UVR – Unit Value Realisation; LPI – Logistic Performance Index

Figure 1: Top 5 Exporters and Trade Statistics in CY 2024 – Brassieres of Textile Materials (HS code 621210)

Source: UN Comtrade, F2F Analysis

China’s position in the US brassiere market: Strengths and growing tariff challenges

China remains the leading exporter of brassieres to the US, with an export value of $579.47 million in 2024 and a Revealed Comparative Advantage (RCA) of 1.98. This relatively high RCA underscores China’s global competitiveness in brassiere production, backed by its efficient manufacturing capabilities and economies of scale.

China’s Unit Value Realisation (UVR) of $21.89/kg places its brassieres in the moderate price range, making them an attractive choice for cost-conscious US consumers. While China has long benefited from low production costs and supply chain efficiency, its price advantage is now under pressure due to the increased tariffs.

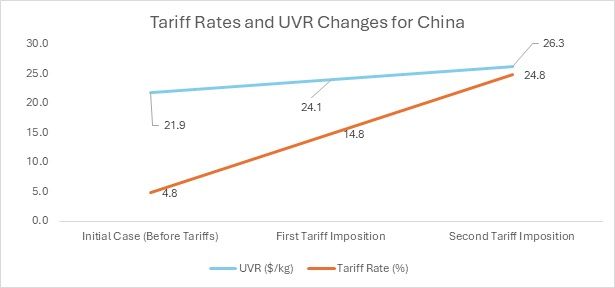

Impact of US tariffs on China’s competitiveness

- Initially, China faced an MFN tariff of 4.8 per cent, while maintaining a competitive UVR of $21.9/kg and remained a preferred choice in the price-sensitive segment.

- However, the imposition of 20 per cent additional tariff, effective March 4, 2025, will significantly increase costs for US importers, making Chinese brassieres less competitive.

Figure 2:

Source: F2F Analysis

Rising tariffs erode China’s competitive edge

China’s synthetic brassieres market is facing increasing pressure due to rising tariffs, which are gradually eroding its cost advantage and shifting its position in the global supply chain.

Impact of first tariff increase: On February 4, 2025, China’s tariff rate increased from 4.8 per cent to 14.8 per cent, significantly raising production and export costs. As a result, China’s UVR would have risen to approximately $24.1/kg, reducing its ability to compete in price-sensitive market segments. This marked the beginning of China’s transition from its traditional low-cost dominance.

Impact of second tariff increase: A month later, on March 4, 2025, tariffs were increased further to 24.8 per cent, pushing China’s UVR closer to $26.3/kg or higher. This substantial cost hike will move Chinese brassieres into the mid-priced segment, making them less attractive to budget-conscious US importers.

Vietnam: Strong competitor with high UVR and competitive pricing

Vietnam ranks second in export value, with $529.62 million in 2024 brassiere exports to the US. While its RCA of 1.65 is slightly lower than China’s, it still indicates a solid competitive position in the market. Vietnam’s UVR of $58.94/kg is significantly higher than China’s, meaning that Vietnamese brassieres are positioned in a higher-end market segment, likely offering superior quality or more specialised designs.

Indonesia: Growing exporter with strong RCA and moderate UVR

Indonesia has shown solid growth in brassiere exports to the US, with an export value of $271.63 million in 2024 and an RCA of 14.57, a significantly higher comparative advantage than both China and Vietnam. Its UVR of $44.43/kg places it in a competitive mid-range pricing category, offering a balance between affordability and quality. Indonesia’s relatively high RCA suggests its production efficiency and expertise in the brassiere sector.

The 4.8 cent tariff applies equally to all countries (now except for China) that export to the US, but Indonesia’s more moderate UVR gives it an advantage in capturing the middle-market segment. Its production costs are likely more aligned with the needs of cost-conscious consumers while offering satisfactory quality, positioning it well for growth in the US market.

Indonesia also has an above average Logistics Performance Index (LPI) of 3.00 indicating better capabilities of dealing with exporting its products to the US. Fuel and energy costs also make a huge difference during transportation in which Indonesia fares better than Sri Lanka and Bangladesh.

Sri Lanka: High-quality niche player with strong RCA

Sri Lanka, with an impressive RCA of 125.93, is a standout performer in terms of comparative advantage. This extremely high RCA suggests that Sri Lanka specialises in producing high-quality brassieres, making it a key player for premium products. The UVR of $67.56/kg reflects the higher-end positioning of its brassieres, likely targeting premium and luxury segments in the US market.

Sri Lanka’s niche market and reputation for superior craftsmanship may allow it to maintain strong demand among discerning US consumers who prioritise quality over cost.

Bangladesh: Competitive position with moderate RCA and UVR

Bangladesh, with an export value of $108.60 million, ranks fifth in terms of brassiere exports. The country’s RCA of 19.60 suggests that it has a reasonable competitive advantage in brassiere production. However, its UVR of $ 28.46/kg is lower than Sri Lanka’s, indicating that Bangladesh’s brassieres are positioned in the more affordable range compared to higher-end producers.

Although Bangladesh is competitive in terms of pricing, it has a smaller market share in the brassiere export market compared to the larger players like China, Vietnam, and Sri Lanka. As US importers turn to alternative sourcing destinations that offer competitive pricing and comparable quality without tariff burdens, Bangladesh—which maintains lower production costs and along with favourable trade relations—could gain market share at China’s expense.

Outlook

As global competition in the US brassiere market evolves, Indonesia is well-positioned to capitalise on its competitive advantage. With an RCA of 14.57 and UVR of $44.43/kg, Indonesia offers a strong balance of affordability and quality, benefiting from a moderate 4.8 per cent tariff and an efficient LPI of 3.00. This enables Indonesia to manage logistics costs effectively, making it a strong contender for increased market share.

China, despite facing higher tariffs, will maintain its position due to its large-scale manufacturing. Although China’s UVR will rise with the tariff hikes, it will likely stabilise at similar levels to its competitors, reducing its traditional cost advantage. While China may lose some market share, its rivals, particularly Vietnam and Sri Lanka, will face challenges in significantly capturing this gap. China’s tariffs, however, do not stop it from leading in the US market in the low-cost category. Bangladesh could eventually benefit from the trade war between China and the US, potentially increasing its market share for brassieres in the US market. Overall, the competitive landscape is likely to remain stable, with Indonesia gradually increasing its share without drastically disrupting China’s dominance.

Fibre2Fashion News Desk (NS)